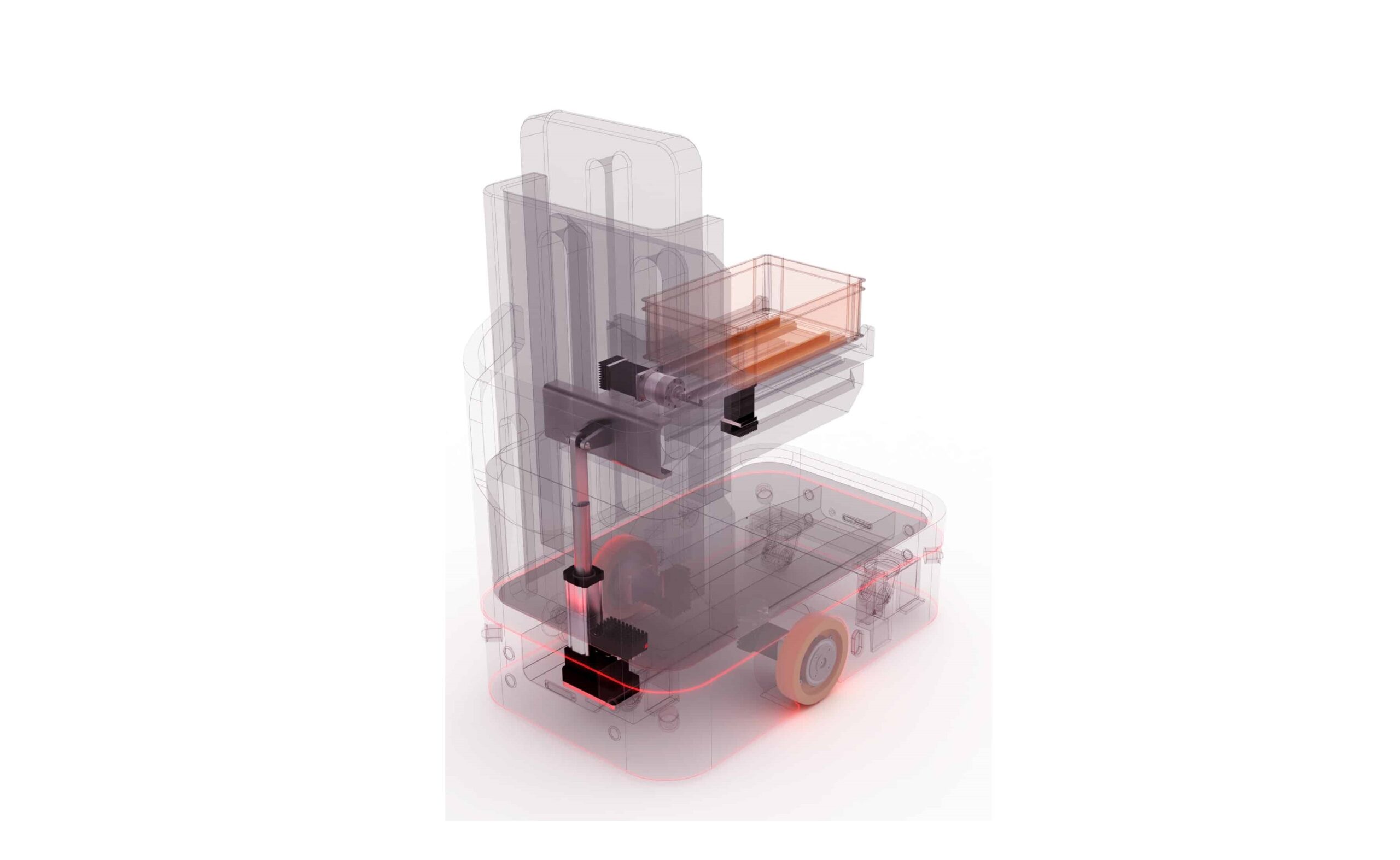

In the field of mobile robotics, STXI covers a diverse range of applications with its decentralized and integrated drive solutions. – Image: STXI Motion Ltd.

The development of motor and drive technology continues to evolve, with four trends in electric motors currently observable in the market for drive technology. Two of these trends are driving the growth of the market for low-voltage drives and motors, while the other two are moving towards higher efficiency, energy efficiency, and sustainability.

In the field of mobile robotics, STXI covers a versatile range of applications with its decentralized and integrated drive solutions. – Picture: STXI Motion Ltd.

The first trend towards mobile and battery-powered applications is fueled by the rapid expansion of the market for Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). This is driving growth within the low-voltage (LV) drives sector. According to market researchers Interact Analysis, this growth is expected to continue at an average annual growth rate of 25.9 percent until 2027. In 2022, the AGV/AMR market accounted for 11 percent of the LV drive sales, and this share is expected to rise to 56 percent by 2027. By then, the market for low-voltage drives and motors used in mobile robotic applications is expected to reach nearly 3 billion US dollars.

Modular and decentralized

A second trend is towards modular machine architectures that use distributed drives and integrated motor solutions. Modular concepts can reduce development costs and shorten time to market. The growing popularity of decentralized technology is also driven by machine builders’ need to design more compact and cost-effective machines. Users who opt for decentralized drive solutions benefit from additional advantages, such as greater flexibility, higher efficiency, less installation and cabling effort, and a smaller machine footprint.

The decision for decentralized rather than centralized solutions essentially depends on the machine builder’s design philosophy. Nevertheless, there are two main cases where decentralization is often financially and technically sensible. One is for machines with a large number of axes, where decentralized solutions enable the greatest savings in terms of installation, wiring, and cabling, installation time, and space requirements. The other benefits applications where the motor is mounted directly on the axis it moves, such as a rotary table or a cartesian system. If the motor moves, the cables have to move with it, increasing the complexity of the mechanics and the likelihood of material wear or fatigue. Using integrated motors in these applications reduces the need for power and signal cables, thereby reducing complexity, as the number of cables, energy chains, and slip rings can be reduced. This in turn has a positive impact on space requirements and potential sources of error.

The market for integrated motors is expected to grow to 840 million US dollars by 2027. Within the market for decentralized drive technology, future growth is particularly strong in sectors such as intralogistics, packaging, food and beverage, printing and textile machines. These are industries where a more modular design concept is advantageous and space saving is of great benefit, as well as advanced drive technology and many servo axes are used.

Efficient and sustainable

The third development in the market is the trend towards highly efficient motors. Reducing energy consumption and CO2 footprint are key priorities on the path to sustainable electrification. The EU and the USA are introducing new minimum energy efficiency standards (MEPS) for electric motors and speed controls. They apply to applications ranging from household appliances and building automation to industrial automation and electric vehicles. The EU regulation for more energy efficiency of electric motors and speed controls 2019/1781 came into force in July 2021. From July this year, the IE4 efficiency class (Super Premium) is prescribed for motors between 75 and 200kW. The resulting annual savings by 2030 are estimated at 110 terawatt hours, equivalent to the electricity consumption of the Netherlands. Consequently, 40 million tonnes of CO2 emissions per year will be avoided, and the annual energy bills of EU households and industry will be reduced by around 20 billion euros by 2030.

With the aim of increasing energy efficiency, new motor designs are using materials such as soft magnetic alloys and composite materials with amorphous or nanocrystalline materials. They improve magnetic induction, enable a significant reduction in magnetic losses, and can also reduce the weight and cost of electric motors. A common approach is also the simple replacement of induction motors with synchronous motors, which have a much higher efficiency. In synchronous motors, the rotor’s magnetic field is geometrically bound to the mechanical position of the rotor. The rotor field can be generated by the magnetic field of permanent magnets, by a current flowing through a winding (wound rotor), or by the stator current itself (reluctance). The most common type of synchronous motors today are permanent magnet motors. However, the use of permanent magnets is associated with higher material costs and risks in the supply chain.

Without permanent magnets

The use of motors without permanent magnets is the fourth trend. This way, risks in the supply chain can be reduced as well as the environmental impacts associated with the extraction of rare earths. In 2022, rare earth permanent magnets were used in 82 percent of all electric cars. Given the initiatives to increase the number of electric vehicles to reduce environmental pollution, there is a clear need to also reduce the environmental damage caused by the extraction and manufacture of rare earth magnets. Alternatives to permanent magnet motors that operate without rare earth magnets include, for example, synchronous motors with wound rotor and reluctance motors.

In motors with a wound rotor, windings are used on the rotor instead of permanent magnets to build a magnetic field, with these rotating windings being supplied with electrical current. This requires a mechanism to conduct the current from the stationary part of the motor to the rotating part of the rotor. Typically, slip rings are used that form a conductive path to the rotor. However, they can prove unreliable as the brushes wear out over time and the resulting accumulation of carbon dust in the motor can sometimes lead to electrical failures. An alternative is inductive excitation, where the energy for the magnetic field is transferred inside the rotor shaft.

Another possibility is motors that utilize the reluctance principle. It is based on the physical properties of the electromagnetic flux seeking the path of least resistance. Examples of these motors are switched reluctance motors and synchronous reluctance motors. These motors have gained increasing attention in recent years as an energy-efficient alternative to induction motors and a magnet-free alternative to permanent magnet motors. Compared to induction motors, their higher efficiency and torque density, coupled with a more robust construction, are clear advantages. Compared to permanent magnet motors, reluctance motors do not require permanent magnets, have no cogging torque, and show good efficiency.

In the past, switched reluctance motors were less popular due to inherent disadvantages such as difficult control, torque ripple, vibrations, and noise. However, advances in motor control electronics and algorithms have significantly improved the control as well as the vibration and noise properties of these motors. Consequently, reluctance motors are experiencing a major comeback due to their energy efficiency, lower risks in the supply chain, and lower costs.